The limitations of ARBs became increasingly apparent, particularly as new financial instruments and complex transactions emerged. This necessitated the establishment of a more formalized and structured approach to standard-setting, leading to the creation of the Accounting Principles Board (APB) in 1959. They aimed to enhance the credibility of the accounting profession by promoting ethical practices and professional judgment.

FAR CPA Practice Questions: Capital Account Activity in Pass-through Entities

This shift was driven by the recognition that piecemeal guidance was insufficient to address the growing complexity of financial reporting. The APB’s work culminated in the issuance of 31 Opinions, which provided more detailed and prescriptive guidance on a wide range of accounting issues, from lease accounting to the treatment of extraordinary items. Before this bulletin, there was no uniform method for accounting for income taxes, leading to significant variations in financial reporting. ARB No. 48 introduced the concept of interperiod tax allocation, which required companies to recognize the tax effects of temporary differences between financial and taxable income. This approach provided a more accurate representation of a company’s financial position and performance, thereby improving the quality of financial information available to investors and other stakeholders. The Committee on Accounting Procedure was an early standard-setting body in the United States and aimed to improve accounting practices and increase consistency and comparability among financial statements.

How Liam Passed His CPA Exams by Tweaking His Study Process

This could result in less-detailed statements if third- or fourth-level issues are not specifically addressed, as they are in many standards at present. It also could result in fewer pronouncements if those that dealt only with very narrow issues were not issued. Rather than accede to the many requests for answers to all possible situations, the FASB should ask itself whether more detail will result in better financial reporting. The answer could be a resounding no if the complexity of new accounting rules outpaced the ability of well-intentioned professional accountants to keep up with and understand them or discouraged appropriate professional judgment. One additional explanation FASB often cites for complicated standards is that corporations lobby aggressively for desired financial reporting outcomes, such as smoothing the effects of transactions on periodic net income.

It’s Time To Simplify Accounting Standards

The bulletins were issued during the 1939 to 1959 time period, and were an early effort to rationalize the general practice of accounting as it existed at that time. Some of these issuances dealt with topics that were highly specific to the era, such as Accounting for Special Reserves Arising Out of the War (ARB 13) and Renegotiation of War Contracts (ARB 15). In total, 51 ARBs were issued, covering topics such as revenue recognition, depreciation, inventory valuation, consolidations, and contingencies, among others. However, the ARBs were criticized for being based on individual cases and lacking a coherent framework or a set of underlying principles. One of the most significant advancements in modern standards is the emphasis on a conceptual framework.

- As countries sought to improve their financial reporting frameworks, many looked to the ARBs as a model for creating their own standards.

- Over time, many of the ARBs were superseded or incorporated into the GAAP framework as accounting standards evolved.

- However, almost all accounting rules require some degree of professional judgment in their application.

Refers to AU 150 (replaced by AU-C 200), a specific section of AICPA’s Codification of Statements on Auditing Standards.You can find a copy of AU 150 on the PCAOB site.

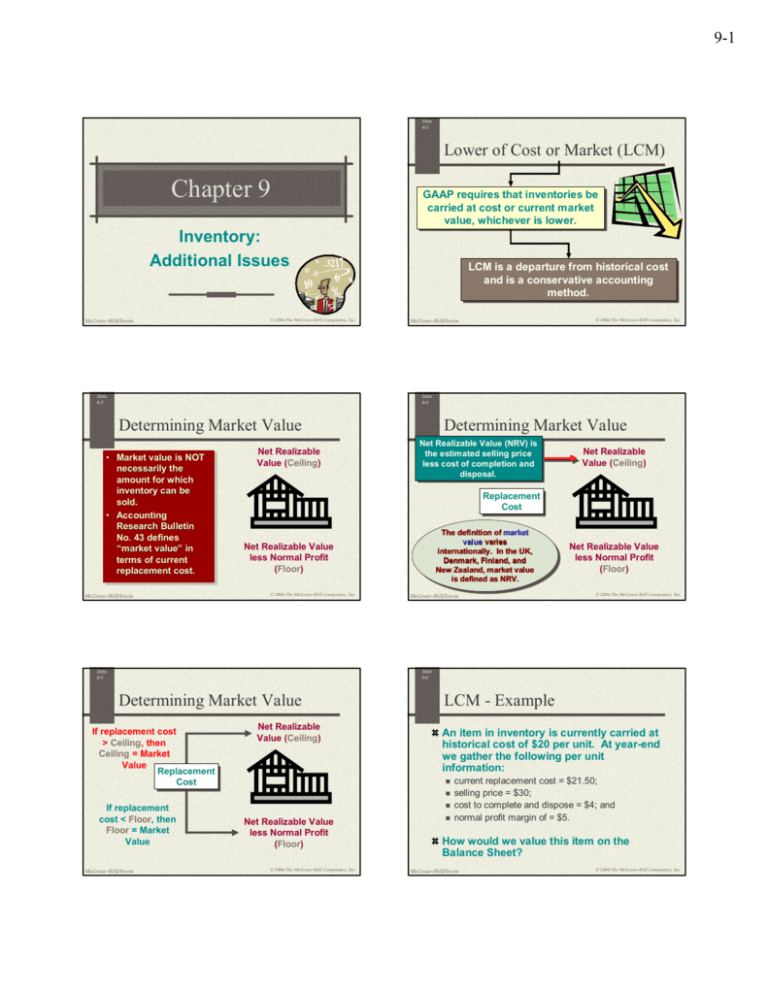

It emphasized that the primary basis of accounting for inventory is cost, which is defined as the sum of the applicable expenditures and charges directly or indirectly incurred in bringing an article to its existing condition and location. Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Many pages of Statement no. 133 are devoted to examples of how the standard applies in certain contexts. However, accountants must carefully read and understand all 245 pages to ensure that the statement is adopted properly, a formidable challenge even for those relatively few accountants with a good understanding of derivatives.

ARB No. 43 is particularly noteworthy because it served as a comprehensive restatement and revision of the previously issued ARBs, consolidating and updating the guidance contained in those bulletins. In 1959, the AICPA replaced the Committee on Accounting Procedure with the Accounting Principles Board (APB), which took over the role of setting accounting standards in the United States. The CAP was replaced by the Accounting Principles Board, which in turn was later replaced by the Financial Accounting Standards Board (FASB). The FASB continues to issue accounting standards on a variety of topics, most of which are aligned with the standards issued by the International Accounting Standards Board (IASB). Accounting Research Bulletins are issuances of the Committee on Accounting Procedure (CAP), which was part of the American Institute of Certified Public Accountants (AICPA).

The primary objective of CAP was to address the inconsistencies and ambiguities in accounting practices by issuing ARBs, which served as authoritative guidance for accountants. The main reason for the increase in the volume and complexity of accounting guidance is that many auditors, corporations and regulators ask for it. While most business people and senior partners of audit firms support general principles in theory, they often ask for much more detailed standards in practice. However, one drawback is that the statement runs 245 pages long, much of it among the most complex text of any accounting standard to date. Later, in 1973, the Financial Accounting Standards Board (FASB) was established as the new independent standard-setting body in the U.S., replacing the APB.

The SEC also tends to seek the maximum in uniform application of accounting standards, even those that include inherently subjective aspects. Many of the issues brought before the EITF result from specific requests for clarification from the SEC accounting staff. Sometimes they come about because the SEC challenges a accounting research bulletin no 43 particular registrant or accounting firm and the registrant or firm asks the EITF to resolve the differences of opinion. In addition to the length and complexity of Statement no. 133—or more likely because of them—FASB had all the Big Five accounting firms help it prepare an educational course on the new standard.