This method allows the current and future cash inflows or outflows to be combined to give a more accurate picture of a company’s current and long-term finances. Accruals are entries used to record an amount of revenue and expenses when they have yet to take place. Investors can use this information to make more informed decisions about a company’s current and future health. For example, under the cash basis method, retailers would look extremely profitable in Q4 as consumers buy for the holiday season. However, they would look unprofitable in the next year’s Q1 as consumer spending declines following the holiday rush. Generally Accepted Accounting Principles (GAAP) are a set of accounting standards that are used to ensure consistency and accuracy in financial reporting.

Accounting Software

Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. All programs require the completion of a brief online enrollment form before payment. If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Example of Accrued Expense

But as your business grows, switching to accrual accounting makes more sense. You can track long-term projects, keep an eye on unpaid invoices, and make better decisions about where your cash is going. This way, you’re not just guessing—you know exactly how much you’ve earned and how much you owe, even if the cash hasn’t moved yet.

- By doing so, companies can accurately account for their liabilities and reflect the true cost of doing business.

- Even more complicated are transactions that require paying for goods or services or receiving money from customers in advance.

- Once they receive payment from their customers or debtors, receivables will go down and their cash account will increase.

- On the income statement, accrued revenues increase the company’s revenue, thus boosting its profitability.

- Accruals are income earned or revenues incurred that are recorded as transactions occur rather than when actual payments are made or received by a business.

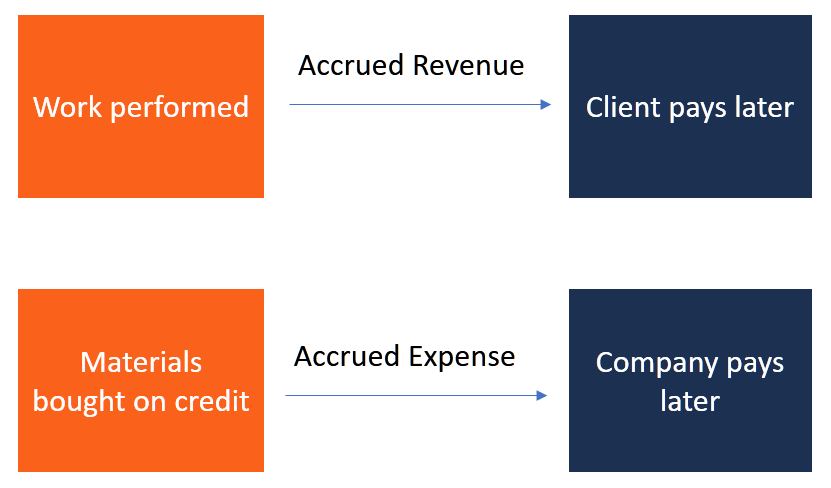

Accounts Payable

This means that if a company provides a service or sells a product, revenue must be recognized at the time of the sale, even if payment is not received until a later date. The choice between the accrual method and cash basis method depends on the needs of the business. Small businesses and individuals may find the cash basis method more suitable, while larger businesses and corporations may prefer the accrual method for a more accurate financial picture. Accrued revenues are going to be income or assets, which also include non-cash assets. It can get broken into two different categories, accrued revenues and accrued expenses. It’s worth highlighting the difference between the accrual accounting method and the cash method.

Which of these is most important for your financial advisor to have?

You get a detailed look into finances and an accurate breakdown of your financial standing. Looking at this example from the outside, it shows that your company becomes a debtor to Ashley for those five vested years. When bonuses get paid, they’re recorded by debiting liability accounts and crediting your cash account. The company needs to wait accruals definition until the end of the month to receive revenue even though they incur expenses throughout the month. It also needs to make sure that it acknowledges that it’s expecting income in the future. One way to offset the people and time resources required under accrual accounting is to invest in accounting software that does the hard work for you.

GAAP standards are used by companies in the United States, while International Financial Reporting Standards (IFRS) are used in other countries. The matching principle requires that expenses be matched to the revenue they help generate. This means that if a company incurs an expense in order to generate revenue, the expense must be recognized in the same period as the revenue. Using accruals can help accountants identify and monitor potential problems. Accruals add an extra layer of information on top of the accounting information you already have.

It provides a more accurate picture of a company’s financial performance and helps to ensure that its financial statements are as accurate and complete as possible. At the end of the day, this basis of accounting provides a more accurate way for the electricity company to track their financial position. Once they receive payment from their customers or debtors, receivables will go down and their cash account will increase.

Investors can view these as real assets and liabilities instead of unrealized gains their balance sheet. It depends on the type of accrual and the effect it has on the company’s financial statements. The liability account will be decreased through a debit and the cash account will be reduced through a credit when the payment is made in the new year.

This means that revenue is recorded when it is earned, and expenses are recorded when they are incurred. Accrual-basis accounting provides a more accurate picture of a company’s financial position than cash basis accounting. The accrual basis of accounting is generally preferred over the cash basis because it provides a more accurate picture of a company’s financial position. Accrual accounting records transactions when they occur, which means that revenue and expenses are recorded in the same period, even if cash is received or paid in a different period. Accrual accounting is a widely used accounting method that records revenue and expenses when they are earned or incurred, regardless of when the cash is received or paid.