The accrual concept in accounting refers to the practice of recording transactions when they occur, regardless of when cash is received or paid. In accrual accounting, revenue and expenses are recognized when they are earned or incurred, regardless of when the payment is received or made. This means that revenue is recognized when goods or services are delivered, and expenses are recognized when they are incurred, regardless of when payment is received or made. Another benefit of accrual accounting is that it provides a more complete picture of a company’s financial position. By recognizing expenses when they are incurred, even if they have not yet been paid, the company’s financial statements will show a more accurate representation of its liabilities and obligations. With accrual basis accounting, accountants need to use the accrual method when recording accruals.

Accrued Expense

The accrual method records revenue and expenses when they are earned or incurred, regardless of when the cash is received or paid. This means that the financial statements are more accurate, as they reflect the true financial position of the company. In contrast, the cash basis method records revenue and expenses when the cash is received or paid, which can result in misleading financial statements. Accrual accounting is a method of accounting that records revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid. This means that revenue is recognized when it is earned, even if the payment is not received until a later date.

The Advantages of Accrual Accounting

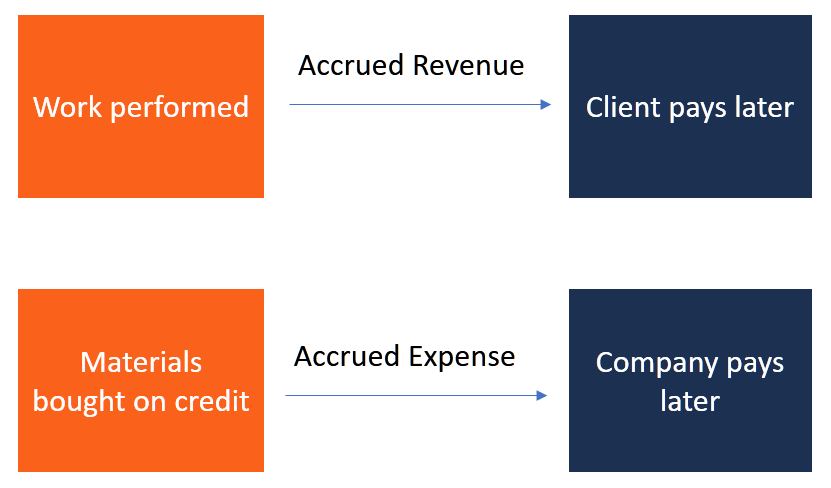

Accrued revenue occurs when a company has delivered a good or provided a service but hasn’t yet received payment. These accounts are often seen in the cases of long-term projects, milestones, and loans. When a company receives cash before a good has been delivered or a service has been provided, it creates an account called deferred revenue, also referred to as unearned revenue. This account is a accruals definition liability because the company has an obligation to deliver the good or provide the service in the future. Under accrual accounting, firms have immediate feedback on their expected cash inflows and outflows, making it easier for businesses to manage their current resources and plan for the future. Under cash accounting, the business only records transactions when an actual movement of cash occurs.

What Is the Difference Between Cash Basis and Accrual Accounting?

Because the utility companies do not bill their customers for the current month but for the next month, the accountant pays the utility bills of January in February and of February in March and so on. Therefore, the company’s accountant has to adjust the entries in the financial statement so that the payments of the bills are reported as accrued expenses. A cash basis system is much simpler (and less costly) than the accrual accounting method, but it won’t work for every system.

Example of Accrued Revenue

This can be especially important for small businesses that are just starting out and need to carefully manage their finances. While cash accounting is a viable option and often a good fit for smaller businesses, accrual accounting generally provides a more comprehensive view of a company’s financial health. Following this method of accounting, you can prepare more accurate financial statements that can be used to inform strategic decisions at your organization. For example, let’s say a company provides services to a client in December but does not receive payment until January of the following year. Under accrual accounting, the company would recognize the revenue in December, even though the cash is received later. This allows for a more accurate representation of the company’s financial performance in December.

With FreshBooks, you can send professional invoices, calculate expenses, accept payments online, and more using industry-standard double-entry accounting. Try Freshbooks free today and see how easy it is to manage your bookkeeping and monitor your financial health from anywhere, on all your devices. It wouldn’t be apparent that you owed $3,000 for lumber until the bill was paid. It occurs when you’ve received a good or service, and the vendor expects you to pay at a later date. For example, if you’re a caterer, and your food supplier provides you with $300 of lamb chops on March 15th, with an invoice due on April 15th, you would call that $300 an accrued expense. For example, imagine a dental office buys a year-long magazine subscription for $144 ($12 per month) so patients have something to read while they wait for appointments.

There can be a lot to consider and take into account when it comes to financial accounting. You want to make sure that you have the proper processes in place to make sure everything is going according to plan. Plus, understanding your financial performance will allow you to make better decisions in the future. The reason is simple — accrual accounting helps large corporations stay compliant, maintain transparency, and keep a true view of their financial performance.

- As a result, more companies are looking for highly skilled financial accounting professionals, well-versed in this method.

- In the intricate world of financial markets, accruals play a vital role in providing a more accurate picture of a company’s financial health.

- Using accrual accounting, companies look at both current and expected cash flows, which provides a more accurate snapshot of their financial health.

- By accurately reflecting a company’s financial performance, accrued revenues provide stakeholders with a clearer understanding of its profitability and future prospects.

Throughout this article, we will explore the definition of accruals, how they function, the different types of accruals, and their impact on financial statements. Furthermore, we will delve into the importance of accruals in financial markets, highlighting their role in accurate financial reporting, evaluating business performance, and assessing cash flow. So, let’s dive into the world of accruals and uncover their significance in the dynamic landscape of financial markets. Accrual accounting is an accounting method in which the accountant records revenues and expenses when they are earned or owed, regardless of when the cash is actually received or paid out. Accrual accounting uses double-entry accounting, where there are generally two accounts used when entering a transaction.

Accrual accounting uses the double-entry accounting method, where payments or reciepts are recorded in two accounts at the time the transaction is initiated, not when they are made. Accrual accounting remains an integral part of financial accounting today because it allows businesses to account for all transactions that have yet to take place concerning revenues and expenses alike. Accrued expenses refer to the recognition of expenses that have been incurred but not yet recorded in the company’s financial statements.