The FASB introduced a more transparent and inclusive standard-setting process, involving extensive public consultation and rigorous due process. This approach not only enhanced the credibility of the standards but also ensured that they were more attuned to the needs of a diverse range of stakeholders. The FASB’s conceptual framework, introduced in the late 1970s, provided a theoretical underpinning for the development of accounting standards, emphasizing the importance of relevance, reliability, and comparability.

It’s Time To Simplify Accounting Standards

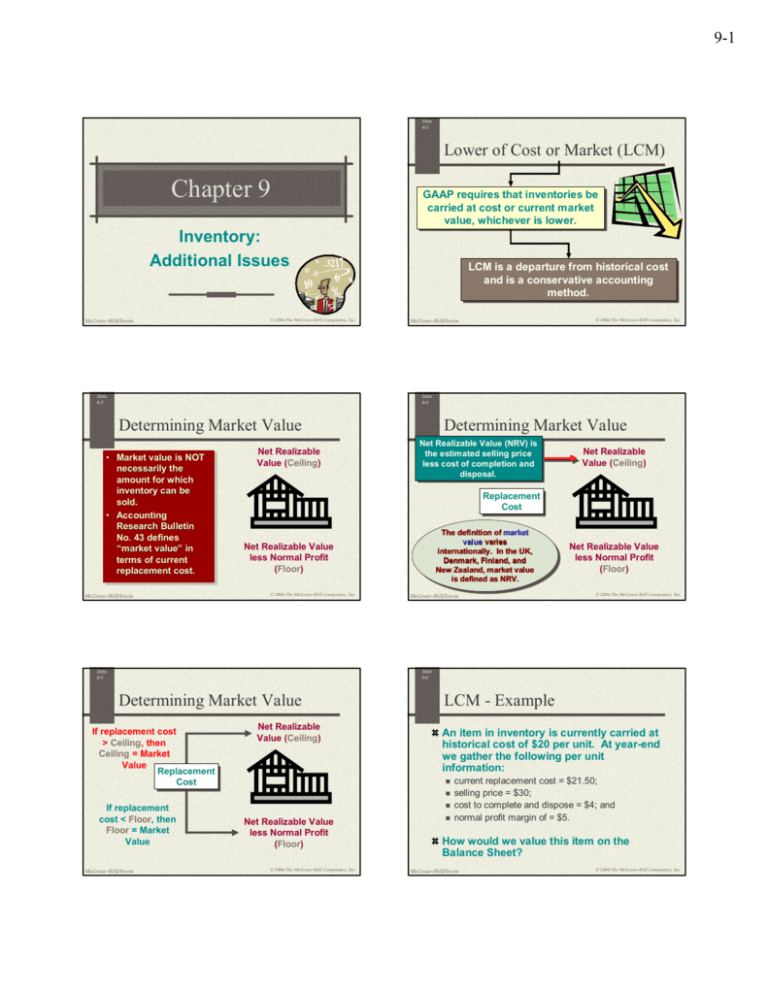

By offering clear guidelines, ARBs helped accountants navigate complex transactions and economic events, thereby fostering greater transparency and accountability. This, in turn, contributed to restoring public trust in financial reporting, which had been severely eroded during the economic turmoil of the 1930s. Their significance lies not only in their historical context but also in how they laid the groundwork for subsequent developments in accounting standards. Understanding ARBs is crucial for comprehending the evolution of accounting principles and their lasting impact on both national and international financial reporting practices. ARB No. 43, along with other ARBs, played an essential role in shaping accounting practices in the United States during its time. However, as mentioned earlier, many of the ARBs have been superseded or incorporated into the current Generally Accepted Accounting Principles (GAAP) framework as accounting standards have evolved.

- The Committee on Accounting Procedure was an early standard-setting body in the United States and aimed to improve accounting practices and increase consistency and comparability among financial statements.

- ARB No. 51 provided clear guidelines on when and how to consolidate financial statements, ensuring that the financial position of a parent company and its subsidiaries was accurately represented.

- Future accounting research will need to explore how these technologies can be integrated into existing frameworks and what new standards may be required to govern their use.

What are Accounting Research Bulletins?

The FASB developed the Generally Accepted Accounting Principles (GAAP), which is the current framework for accounting standards in the United States. Over time, many of the ARBs were superseded or incorporated into the GAAP framework as accounting standards evolved. One example of an Accounting Research Bulletin (ARB) is ARB No. 43, “Restatement and Revision of Accounting Research Bulletins,” which was issued in June 1953.

How Liam Passed His CPA Exams by Tweaking His Study Process

This framework serves as a foundation for developing consistent and logical standards, ensuring that new guidelines are not only internally coherent but also aligned with overarching principles such as relevance and faithful representation. This contrasts with the more ad-hoc nature of ARBs, which, while effective in addressing immediate concerns, lacked a unifying theoretical basis. Explore the historical evolution, impact, and future directions of Accounting Research Bulletins on financial reporting and international practices. Accounting Research Bulletins were documents issued by the US Committee on Accounting Procedure between 1938 and 1959 on various accounting problems. The Accounting Research Bulletins have all been superseded by the Accounting Standards Codification (ASC). Even more problematic is that the SEC expects public companies to follow guidelines set out in speeches by SEC accounting staff members at various conferences, particularly the annual AICPA National Conference on Current SEC Developments.

Not addressing every possible issue will require corporate financial executives, auditors, regulators and other interested parties to recognize that professional judgment must play a more important role in financial reporting. At the same time, corporations and auditors, in particular, must continue to earn the trust of users of financial statements that judgment will not be abused. Also, all interested parties, not just the FASB, must assume a large part of the responsibility for simplification. They must make specific suggestions on how to simplify individual standards as well as the overall reporting framework without diminishing the quality of information to users.

Sustainability and environmental, social, and governance (ESG) reporting are also gaining prominence in the accounting field. Investors and stakeholders are increasingly demanding more comprehensive disclosures on a company’s ESG performance. This shift towards sustainability reporting requires the development accounting research bulletin no 43 of new metrics and standards to ensure that ESG information is reliable, comparable, and relevant. Accounting research will play a crucial role in shaping these standards, drawing on the lessons learned from the evolution of financial reporting standards to create a robust framework for ESG reporting.

A FASB-sponsored derivatives implementation group began meeting in early September and is expected to develop even more detailed interpretations. The FASB’s emerging issues task force (EITF) and the SEC accounting staff may weigh in with still more guidance in time. Despite the APB’s efforts, criticisms persisted regarding the lack of independence and the perceived influence of vested interests. These concerns ultimately led to the establishment of the Financial Accounting Standards Board (FASB) in 1973.

And they must be willing to actually accept general principles and apply them in good faith, which includes resisting the temptation to invoke the show me notion. Before its issuance, there was significant ambiguity regarding the treatment of subsidiaries and affiliated companies. ARB No. 51 provided clear guidelines on when and how to consolidate financial statements, ensuring that the financial position of a parent company and its subsidiaries was accurately represented. This bulletin was particularly impactful for large conglomerates, as it provided a standardized approach to presenting their financial results. But perhaps the best explanation for creeping complexity of accounting standards is that business itself has become so much more complex. Derivative financial instruments and securitization transactions, for example, are inherently complicated and may not be adequately covered by general accounting principles.