In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. The IRS 12-month rule states that taxpayers do not have to capitalize amounts paid that will benefit them within a 12-month period. In other words, you may be able to deduct a full advance payment on a service if the benefit to your business is realized within 12 months of the payment. To learn more about cash and accrual accounting and how each may help your small business grow, please see the following frequently asked questions.

Difficult to Track Cash Flow

Some of the most common accrued expenses can include interest accruals, supplier accruals and wage or salary accruals. An electricity company provides utilities to their customers who then use that electricity. The meter keeps track of the electricity consumption and the customer gets billed at the end of the billing period. But, the electricity company still needs to pay their employees and take on additional overhead and expenses.

- That’s because it doesn’t record accounts payables that might exceed the cash on the books and the company’s current revenue stream.

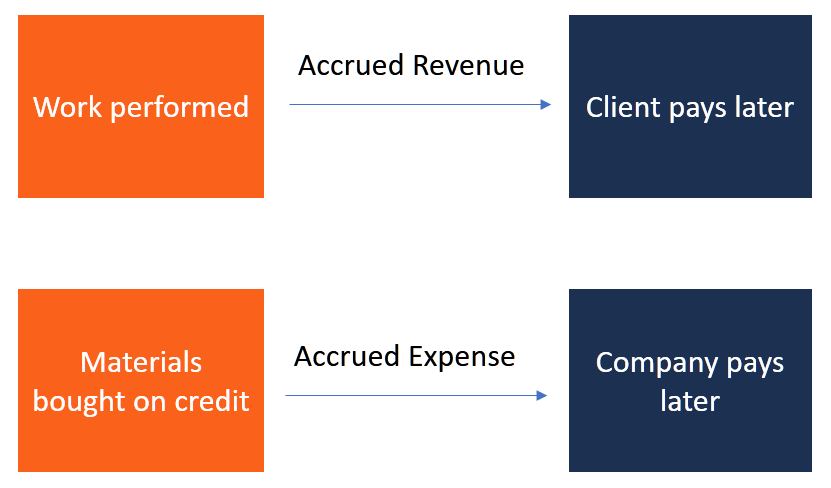

- On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out.

- These entries ensure that the proper amounts are reported on the financial statements, providing a more accurate picture of a business’s financial position.

- But if you’re not an accountant it can be overwhelming to try and understand everything that goes into financial accounting.

When Should You Use the Accrual Basis of Accounting?

Finally, accruals for landlord and utility company expenses can be a challenge in accrual accounting. These expenses can vary from month to month, which can make it difficult to accurately predict and record them. To overcome this challenge, companies need to carefully monitor these expenses and adjust their accruals accordingly. Accounting software is a must-have for any business that wants to keep track of its financial transactions. Many popular accounting software options, such as QuickBooks and Xero, offer accrual accounting as a standard feature. These programs can automatically generate and track invoices, record expenses, and reconcile bank accounts, making it easier to stay on top of your financials.

Subscription Services

If they have an accrual asset (such as accounts receivable), it means there is more likely to be cash waiting on their balance sheet than what actually exists internally. Accruals are created when revenue is earned, or expenses are incurred, but the corresponding cash has not been received or paid yet. Accrued interest refers to interest that’s been earned on an investment or a loan but hasn’t yet been paid. It would be recorded as an accrual on the company’s financial statements if the firm has a savings account that earns interest and the interest has been earned but not yet paid.

Recording cash transactions based on when you complete services, deliver products, and incur expenses is also beneficial to your business. This means you already paid for the goods or services that you’re yet to receive. Differently than accrued revenue, deferred revenues happen when a customer has paid for a good or service you haven’t yet provided.

One reason for the accrual method’s popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they’re generated. The accrual method records accounts receivables and payables and, as a result, can provide a more accurate picture of the profitability of a company, particularly in the long term. Investing in accurate software and tools can help companies overcome many of the challenges of accrual accounting. This includes software for tracking inventory and cost of goods sold, as well as tools for calculating depreciation expenses.

If a company does not meet the average revenue requirement, it can choose to use cash basis or accrual as its accounting method. Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and record expenses as they are incurred. Accruals do come with several pros and cons, but the main issue is the degree of accuracy involved. This information should accruals definition always be used alongside other performance metrics to provide an accurate picture for investors. Accrued revenue and expenses can be manipulated, which means that net income may not always accurately represent how profitable a business is. Accruals also make it more difficult to track both current and past performance metrics because investors will have to rely on estimates until these transactions actually occur for real.

There are so many different terms and processes to know when it comes to accounting. This method of accounting documents and measures your revenues and expenses when they occur. Whereas accrual accounting’s strengths lie in accurately showing business profitability and representing long-term revenues and expenses, it has a few drawbacks as well. Still, it’s important to review the IRS guidelines on how to report an advance payment for services using the accrual accounting method. Accrual basis accounting recognizes revenue when the service is provided for the customer even though cash isn’t yet in the bank yet. A profit is noted as soon as a client places an order, and an expense is recorded when a bill arrives or a service is rendered.

Similarly, expenses are recognized when they are incurred, even if the payment is not made until a later date. This method of accounting is widely used in businesses of all sizes, as it provides a more accurate picture of a company’s financial position. Accrual-basis accounting records transactions when they occur, regardless of when cash is received or paid.