Content

Decentralised finance (DeFi) apps, a special class of dapps that take advantage of the decentralised nature of blockchain for financial activities, are used for cryptocurrency trading, lending, and more. Crypto.com’s DeFi Wallet is built on this kind of technology, providing a number of great features and security while remaining fully non-custodial. Users’ private keys are entirely theirs, which is not the case for custodial wallets. Bitcoin (BTC), the world’s first blockchain-based digital currency, is the largest cryptocurrency product by metrics like market capitalisation and number of unique crypto wallets holding it. Ether (ETH) Financial instrument follows as the native cryptocurrency used in the Ethereum network. Ether (ETH), the native cryptocurrency of the Ethereum network, is the second most popular digital token after bitcoin (BTC).

Bitcoin vs. Ethereum: Similarities, differences and considerations

In fact, Bitcoin is the first blockchain created to eliminate the need for authorities such as banks or government organizations to transfer money. This blockchain was launched in 2009 and was the first network that https://www.xcritical.com/ allowed users to directly transfer funds between each other without the need for intermediaries, such as banks or governments. On the other hand, Ethereum can process around 30 transactions per second, and new blocks are added approximately every 15 seconds. Ethereum not only supports basic transactions but can also handle complex transactions related to decentralised applications. To address scalability challenges, Ethereum employs a multi-layered approach involving various Layer 2 networks with different technological approaches.

Top 10 DeFi Platforms to Watch Out for in 2024

As the second-largest cryptocurrency by market capitalization (market cap), comparisons between the two are natural. The cryptocurrency market is a Wild West, so those speculating in these digital assets should not put in more money than they can afford to lose. It’s also important to note that individual investors often trade against highly sophisticated players, making it a fraught experience for novices. Compare cryptocurrencies against each other and start trading cryptocurrency CFDs with IG. We offer more than ten of the most popular cryptocurrencies, including bitcoin, ether, litecoin, EOS, stellar (XLM) and NEO. The differences between each cryptocurrency can offer blockchain vs ethereum insights into how the value of each coin will change over time.

- It was designed to be a digital alternative to traditional currencies, offering security and decentralization.

- The first miner to successfully solve the problem gains the opportunity to add a new block to the blockchain and is rewarded with Bitcoin for their efforts.

- Cryptocurrencies are virtual currencies which operate independently of banks and governments but can still be exchanged – or speculated on – just like any physical currency.

- In PoS, validators are chosen to create new blocks based on the number of tokens they hold and are willing to “stake” as collateral.

- Others claim that blockchain technology can be made more scalable through technical improvements.

- It introduced Bitcoin as an online currency without any central authority, unlike government-issued currencies.

Bitcoin vs Ethereum: A comprehensive crypto guide

BTC is also used to pay transaction fees to miners when they generate new blocks, and can be used as a medium of exchange or long-term store of value. Since Bitcoin is popular worldwide, it can be used as an online payment instead of fiat currency on some websites and markets. Other uses of Bitcoin are in gaming, transaction fee, investment, developing apps, and donations. Still, since its protocol differs from other blockchain platforms, Bitcoin doesn’t support NFTs like other cryptocurrencies. Instead, NFTs are created and collected using different methods and standards.

The transition from PoW to PoS aims to make the network more efficient and capable of handling a higher volume of transactions. This upgrade is expected to enhance Ethereum’s position in the crypto market and attract more developers and users to its platform. At the core of both Bitcoin and Ethereum cryptocurrency lies blockchain, a decentralized ledger that records all transactions across a network of computers. Each block contains a list of transactions and is linked to the previous block, forming a chain. This ensures transparency and security, as altering any information would require consensus from the entire network. Bitcoin and Ethereum are two titans in the cryptocurrency market, each with its own unique attributes and use cases.

Bitcoin’s smart contracts are written in programming languages like Script and Clarity. Thirdly, a large number of nodes ensures that any user can broadcast their transaction and route around potential censorship. If a user can only connect to malicious nodes who refuse to relay their transaction, the user will be unable to have their transaction confirmed. Firstly, Bitcoin’s rules are enforced by nodes, not miners or developers, so it is important that a large number of Bitcoin nodes are operated by many parties. If one or a few entities control all or a significant majority of the nodes, they may be able to implement changes at will, degrading Bitcoin’s consensus.

Despite subsequent corrections and periods of volatility, Bitcoin has maintained its position as the leading cryptocurrency by price and market cap, dominating the rest of the market. And although there have been skeptics along the way, Bitcoin has continued to attract investment from users and institutions seeking a store of value and hedge against inflation. However, it cannot be confirmed that Bitcoin indeed serves as a suitable vehicle for either. Ethereum’s primary smart contract language, Solidity, enables developers to write complex smart contracts and decentralized applications (dApps). There are also alternative languages like Vyper that offer different approaches to smart contract development. Bitcoin and Ethereum serve as cornerstones of the cryptocurrency ecosystem, yet their utility extends beyond mere digital assets and financial transactions.

Being the biggest digital assets in the market, investors compare the community support and adoption rates as proxies for the networks’ resilience, innovation potential, and long-term viability. Ethereum introduced the concept of a blockchain smart contract platform. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce and execute the terms of the agreement based on predefined rules, eliminating the need for a middleman in many types of transactions.

When a new block needs to be mined, the network randomly picks a validator node and they then produce and distribute the new block. ETH uses a Proof-of-Stake (PoS) mechanism, so the Ethereum network is more scalable than the Bitcoin network. Ethereum is solving the scalability issue through the sharding process. Ethereum allows the creation of smart contracts that run on blockchain and are executed when the predetermined terms and conditions are met.

Digital money or currency can work similarly to traditional currencies and fiat. Bitcoin is also considered “digital gold” due to its store of value as a hedge against traditional financial volatility. The supply of a cryptocurrency is the total number of coins that can ever be available or created at any time. Ethereum is an open-source platform for creating smart contracts and decentralised applications or dApps. DApps and smart contracts can interact directly without the need for a middleman.

Bitcoin is the first asset in history with provable, absolute scarcity and unforgeability. Since its inception, Bitcoin’s monetary policy has never been altered, creating credibility around its long term immutability. These features make Bitcoin the prime candidate to become the reserve currency of the world. Ethereum’s methodology has resulted in better performance, outpacing Bitcoin by 100,000%. Learn how to track XRP transactions, check balances, access developer tools, and explore the XRPL ecosystem.

Ethereum’s shift to PoS seeks to maintain network security and consensus through staked assets, offering a more energy-efficient alternative that could set a precedent for future blockchain development. Proof-of-stake blockchains do not require mining; instead, they use a process called staking, which incentivizes people to put cryptocurrency at stake to vouch for the accuracy of transactions. Participating users get rewards akin to interest in a bank account when the system works normally. The answer to the question of which cryptocurrency is better in the choice between Bitcoin vs. Ethereum, it depends entirely on your requirements. While Bitcoin works better as a peer-to-peer transaction system, Ethereum works well when you need to create and build distributed applications and smart contracts.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Bitcoin and Ethereum are popular choices when looking for “safer” investments. They have lower volatility, higher capitalization, and more trading pairs.

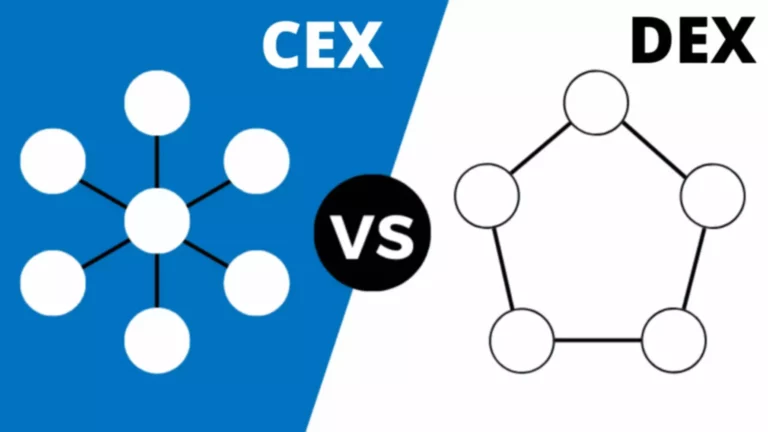

Bitcoin and Ethereum are two blockchains with their own cryptocurrencies, bitcoin and ether. Each was created with different purposes in mind to address separate issues, but they also have many similarities. In layman’s terms, a cryptocurrency exchange is a place where you meet and exchange cryptocurrencies with another person. The exchange platform (i.e. Binance) acts as a middleman – it connects you (your offer or request) with that other person (the seller or the buyer). With a brokerage, however, there is no “other person” – you come and exchange your crypto coins or fiat money with the platform in question, without the interference of any third party.

However, one thing you can’t escape with either cryptocurrency is network fees. Any time you carry out a transaction with either Ethereum or Bitcoin, you’ll be charged an amount that helps pay for the network’s technology. These fees can sometimes come on top of whatever fee you might be paying to the crypto platform or payment provider you’re using. Bitcoin has over 18 million bitcoins currently in existence, and Ethereum has 118 million ether. Now even though Ethereum has easily crossed the 100 million mark, the market capitalization for Bitcoin is $781 billion, whereas for Ethereum it’s only $368 billion. So even though Ethereum has more coins on the market, it isn’t at the level of Bitcoin.