This is important because it allows companies to accurately track their financial position and make informed decisions about their operations. Accrual accounting is a method of accounting that records transactions when they occur, regardless of when payment is received or made. The principles of accrual accounting include the revenue recognition principle, the matching principle, adherence to GAAP, and consistency in accounting methods.

Firm of the Future

Most transactions a company has are straightforward, with payment happening at the time of the transaction. Other, more complicated transactions involve buying and selling on credit, which requires a company to account for monies that they will have to pay or receive at a future date. They provide a more nuanced understanding accruals definition of a company’s operations, financial stability, and future prospects. Investors and analysts heavily rely on accruals to evaluate the financial performance and prospects of a company, making informed investment decisions. The accrual method is the more commonly used method, particularly by publicly traded companies.

Accrual Accounting vs. Cash Basis Accounting: An Overview

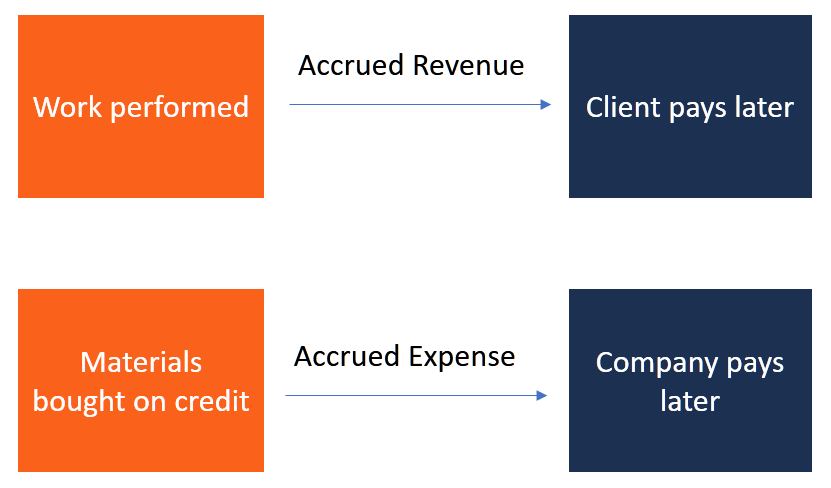

Accrued expenses, also known as accrued liabilities, occur when a company incurs an expense it hasn’t yet been billed for. Essentially, the company received a good or service that it will pay for in the future. Accrual accounting is helpful because it shows underlying business transactions, not just those with cash involved.

What is accrual accounting? A beginners guide

Yes, it’s always possible to switch from the cash method to accrual accounting or vice versa. It’s a big undertaking that will require a full system overhaul, and you’ll need to file Form 3115 with the IRS, but it’s your business, and you can run it how you want to. Accrued revenue is the term used when you’ve provided a good or service, but the customer has not yet paid. For example, if you were to build a custom shed for a client and invoice them when the work is complete, the amount they owe you would be the accrued revenue from that job. As each month of the year passes, the dental office can reduce the prepaid expense account by $12 to show it has ‘used up’ one month of its prepaid expense (asset).

- Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and record expenses as they are incurred.

- Understanding assets and liabilities is crucial for any company that wants to accurately track its financial position and make informed decisions about its operations.

- Using accruals can help accountants identify and monitor potential problems.

- Accrual accounting is a method of accounting that records transactions when they occur, regardless of when payment is received or made.

This method is more accurate than cash basis accounting because it tracks the movement of capital through a company and helps it prepare its financial statements. The journal entry would involve a debit to the expense account and a credit to the accounts payable account for accrued expenses. This has the effect of increasing the company’s expenses and accounts payable on its financial statements.

Understanding Assets and Liabilities

Accrued revenues have a significant impact on a company’s financial statements. When accrued revenues are recorded, they affect both the income statement and the balance sheet. Under cash basis accounting, revenue is reported on the income statement only when cash is received. The cash method is typically used by small businesses and for personal finances. Interest and interest expense accruals are used to record interest that has been earned or incurred but has not yet been paid or received.

Prepaid expenses are assets that represent payments made in advance for goods or services that will be received in the future. This would be recorded as a prepaid expense and would be gradually expensed over the course of the year. Accrual accounting is an important aspect of financial accounting and is used by many companies around the world.

Similarly, bills for expenses incurred can be recorded as they are received, even if payment is not made until a later date. Accrual accounting also requires the use of journal entries and double-entry accounting, which ensures that all transactions are properly recorded and balanced. This provides a clear and accurate record of a company’s financial activities, making it easier to prepare financial statements and comply with tax laws.

For example, a business may have billed their customers $100 on January 15th for services provided in December of last year (accrued revenue). Accruals are important because they help to ensure that a company’s financial statements accurately reflect its actual financial condition. Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later.