If such all-in-one-place guidance were put together, FASB or other groups doing the job might even find that there are quite a few standards that have outlived their usefulness and can be eliminated. SIMPLICITY AS A STRATEGY In 1992 FASB preliminarily addressed many of the concerns of constituents through a three S program—for selectivity, speed and simplicity. The rise of digital reporting and data analytics has necessitated more detailed and granular standards to ensure accuracy and transparency. For instance, the adoption of the Extensible Business Reporting Language (XBRL) has revolutionized how financial data is reported and analyzed, enabling real-time access and comparability across different jurisdictions.

American Institute of Accountants

BALANCING STANDARDS AND JUDGMENT Professional judgment and common sense augmented by analogies to other standards can guide the accounting for many new accounting issues. Most parties agree that financial reporting is not useful unless there is a reasonable degree of comparability from company to company. Readers cannot place much credibility in financial statements if, for example, one company decides that an expenditure qualifies as an asset and another company decides that the same expenditure is a current period expense. However, almost all accounting rules require some degree of professional judgment in their application. The challenge to standards setters is to provide enough specifics to ensure parallel application without going overboard on detail.

What are Accounting Research Bulletins?

The ARBs were influential in shaping the development of accounting principles in the U.S. during that time. The evolution from Accounting Research Bulletins to contemporary standards highlights a remarkable journey of increasing sophistication and precision in financial reporting. ARBs were pioneering in their time, providing much-needed guidance in an era of fragmented practices. The issuance of Accounting Research Bulletins marked a significant step towards the standardization of accounting practices, but the journey did not end there. As the business environment continued to evolve, so too did the need for more robust and comprehensive accounting standards.

- FASB itself is in the process of amending the statement in certain respects, and a document has been recently issued by FASB staff covering numerous other implementation questions and answers.

- Many pages of Statement no. 133 are devoted to examples of how the standard applies in certain contexts.

- This bulletin was particularly impactful for large conglomerates, as it provided a standardized approach to presenting their financial results.

Influence on Financial Reporting and International Practices

Accounting standards setters, encouraged by questions from auditors, company representatives and the SEC, consequently are tempted to go overboard and pursue uniformity past the point of diminishing returns. The result is rules that only a specialist can interpret and accounting that may lose sight of the objective of meaningful reporting. In fact, many parties suggest that detailed rules only encourage loophole identification followed by even more rules.

The International Accounting Standards Board (IASB), established in 2001, has been instrumental in promoting global convergence of accounting standards. The IASB’s International Financial Reporting Standards (IFRS) have been adopted by over 140 countries, reflecting a commitment to a unified set of high-quality accounting standards. The foundational work of ARBs, with their emphasis on consistency and comparability, can be seen in the principles underlying IFRS.

Where to Find Standards When You Have a Citation

Thus, interested parties must search the above sources—and perhaps others, too—to see whether there is accounting literature on point and then decide how it applies to the issue under consideration. While computers help greatly in the identification of applicable literature, humans still must read the material and decide how it should be interpreted. Gains and losses on those instruments are reflected in income in the same periods as offsetting losses and gains on qualifying hedged positions.

The inception of Accounting Research Bulletins (ARBs) can be traced back to a period of economic upheaval and transformation. The Great Depression had exposed significant flaws in financial reporting, leading to a loss of investor confidence and a demand for more reliable and transparent accounting practices. In response, the American Institute of Accountants, now known as the American Institute of Certified Public Accountants (AICPA), established the Committee on Accounting Procedure (CAP) in 1939.

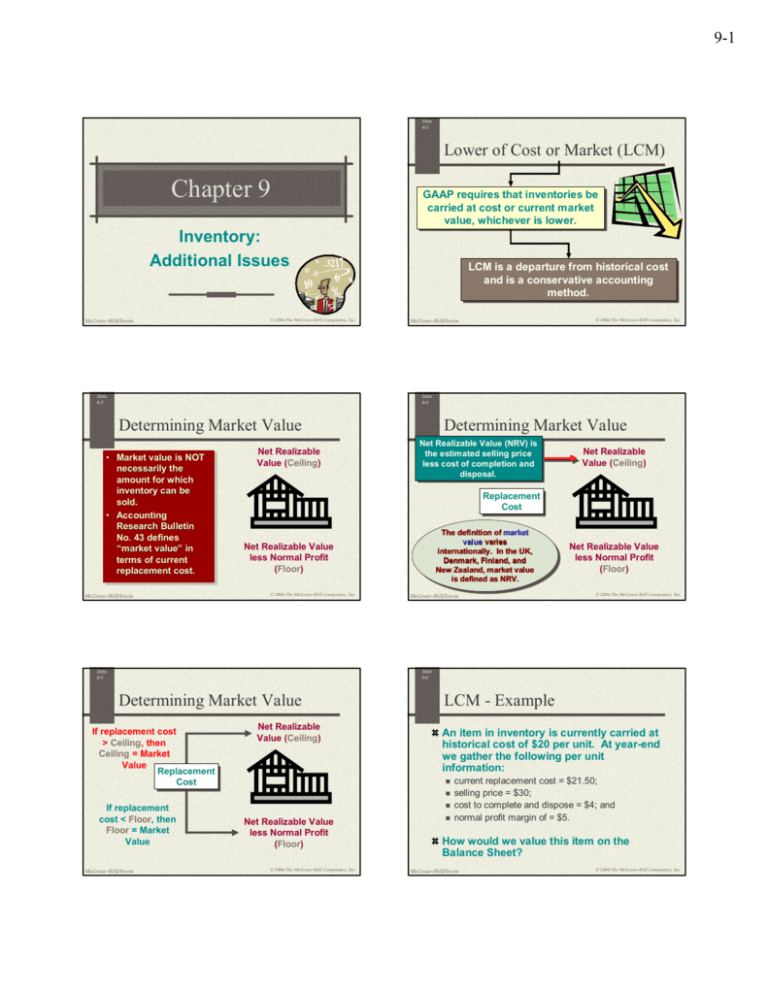

Among the numerous Accounting Research Bulletins issued, several stand out for their profound influence on the accounting profession. Issued in 1953, it consolidated and revised previous bulletins, providing a comprehensive framework that addressed a wide array of accounting issues. This bulletin was instrumental in standardizing practices related to inventory valuation, depreciation, and the classification of current and non-current assets. By offering detailed guidance on these topics, ARB No. 43 helped reduce inconsistencies and improved the comparability of financial statements across different entities.

And actions taken by companies to sell their products internationally, protect against a multitude of financial and other risks, adjust to new technology and react to other developments often raise new accounting issues. CREEPING COMPLEXITY Regrettably, this level of complexity of generally accepted accounting principles has become more the norm than the exception. Although Statement no. 125 is very detailed, after it was issued many parties asked FASB to be even more specific about the accounting for securitizations and certain other common accounting research bulletin no 43 transactions, so the EITF developed several interpretations. FASB itself is in the process of amending the statement in certain respects, and a document has been recently issued by FASB staff covering numerous other implementation questions and answers. All of this is designed to help accountants apply the fairly basic concept in Statement no. 125 that assets are considered effectively sold when they are no longer controlled. Another noteworthy bulletin is ARB No. 45, which addressed the accounting for changes in accounting estimates.