Accurately tracking inventory and cost of goods sold is another challenge in accrual accounting. This is especially true for companies that have a large inventory or a high volume of sales. To overcome this challenge, companies need to invest in software and tools that can help them track inventory and cost of goods sold accurately. For businesses that don’t want to invest in expensive software or hardware, there are many subscription-based services available. These services offer cloud-based accrual accounting software that can be accessed from anywhere with an internet connection. The revenue recognition principle requires that revenue be recognized when it is earned, not when payment is received.

- For example, if a company sells a product in December but does not receive payment until January, the revenue is still recognized in December because that is when the sale was made.

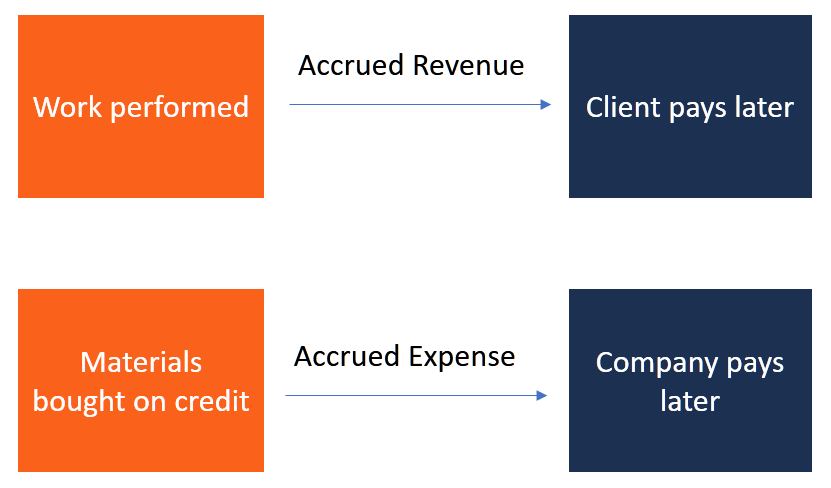

- It can get broken into two different categories, accrued revenues and accrued expenses.

- Accruals are earned revenues or expenses incurred that impact a business’s net income.

- Salaries are accrued whenever a workweek does not neatly correspond with monthly financial reports and payroll.

Potential Challenges and Solutions in Accrual Accounting

Although it’s the more complex of the two major accounting methods, accrual accounting is considered the standard accounting practice for most organizations. Using accrual accounting, companies look at both current and expected cash flows, which provides a more accurate snapshot of their financial health. In other words, the revenue earned and expenses incurred are entered into the company’s journal regardless of when money exchanges hands. Accrual accounting is usually compared to cash basis of accounting, which records revenue when the goods and services are actually paid for. Accruals impact a company’s bottom line even though cash has not yet changed hands.

What Is Accrual Accounting?

It can be difficult to accurately calculate the depreciation of assets, which can lead to inaccurate financial statements. To overcome this challenge, companies need to invest in software and tools that can help them accurately calculate depreciation expenses. By issuing invoices for goods and services rendered, businesses can record revenue as it is earned, even if payment is not received until a later date.

Accruals are an indicator of how profitable a company is.

The three accounting methods are cash basis accounting, accrual accounting and modified cash basis accounting, which combines cash and accrual accounting. Accrual accounting is an accounting method that records revenue and expenses when you provide or receive a product or service instead of when you make or receive a payment. Accrual accounting is an accounting method that recognizes revenue in the period in which it’s earned and realizable, but not necessarily when the cash is actually received. Similarly, expenses are recognized in the period in which the related revenue is recognized rather than when the related cash is paid.

Suppose a company relies on a utility, like an internet connection, to conduct business throughout the month of January. However, it pays for this utility quarterly and will not receive its bill until the end of March. Even though it can’t pay for it until March, the company is still incurring the expense for the entire month of January. The expected cost of internet for the month will need to be recorded as an accrued expense at the end of January.

Accurate Financial Reporting:

It can simultaneously record an expense of $12 each month to show that the expense has officially incurred through receiving the magazine. As each month of the year passes, the gym can reduce the deferred revenue account by $100 to show it’s provided one month of service. It can simultaneously record revenue of $100 each month to show that the revenue has officially been earned through providing the service. Since accrual expenses and revenues exist, investors can easily determine how quickly a company pays off its liabilities or collects on its receivables.

Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Assume that Company ABC hires Consulting Firm XYZ to help on a project that is estimated to take three months to complete. While ABC owes XYZ $50,000 after each monthly milestone, the total fee accrues over the duration of the project instead of being paid in installments.

In this section, we will discuss some potential challenges and solutions in accrual accounting. In accrual accounting, assets and liabilities are key components of the balance sheet. Assets are resources that a company owns and can use to generate revenue, while liabilities are obligations that a company accruals definition owes to others. When it comes to financial accounting, accruals can cover a broad range of revenues and expenses. While accrual accounting may be considered a more complex method than cash accounting, it can provide bookkeepers and accountants with a more accurate long-term view of a business’s finances.

In large businesses, accrual accounting is essential for accurate financial reporting. Large businesses often have complex financial transactions and accrual accounting provides a more accurate reflection of their financial position. By using accrual accounting, large businesses can better manage their finances and make informed decisions about their operations.