It doesn’t provide a complete picture of a company’s financial health, as it doesn’t take into account any transactions that have been invoiced but not yet paid or received. While some very small or new businesses use cash accounting, companies normally prefer the accrual accounting method. Accrual accounting gives a far better picture of a company’s financial situation than cost accounting because it records not only the company’s current finances but also future transactions. In accrual accounting, revenue is recognized when it is earned, regardless of when the payment is received.

Accrual Accounting vs. Cash Basis Accounting: An Overview

To learn more about accounting principles and concepts, check out our accounting principles glossary entry. While there are several advantages to accrual accounting, there are also some disadvantages to know about. A business’s expenses can include any costs related to running the company such as rent, utilities, office supplies, property, equipment, and payroll. If your company needs to purchase raw lumber for $3,000 to build more furniture, you would record the $3,000 as an expense immediately, even if you aren’t able to pay until next week or next month. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

Accounting Software

It takes a lot of time and energy to maintain years’ worth of financial documents, checking and updating them as needed. This is why as businesses grow, they hire a part-time or full-time accountant to handle the important bookkeeping and accounting duties of the company. This may be too expensive for a small business but may be beneficial in the long term.

What is your current financial priority?

While accrual accounting focuses on recording revenues and expenses when they are earned or incurred, it also facilitates the assessment of cash flow. By tracking the timing of cash inflows and outflows, businesses can effectively manage their liquidity and determine their ability to meet financial obligations. Accrual accounting is widely used in various industries and is the preferred method of accounting for most businesses. It provides a more accurate picture of a company’s financial health by recognizing revenue and expenses when they are earned or incurred, rather than when cash is received or paid. By recognizing revenues and expenses in the period they are earned or incurred, accrual accounting allows for a more accurate assessment of a company’s profitability. This is especially important for businesses that rely on long-term projects or contracts, where cash flows may not align with the actual work performed or services rendered.

Accrual Accounting

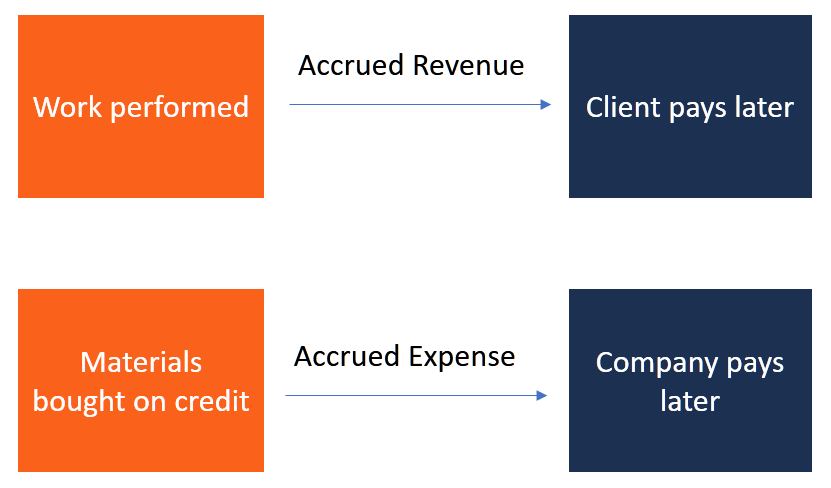

- Accrual accounting is an accounting method in which payments and expenses are credited and debited when earned or incurred.

- This accurately reflects the costs incurred during the accounting period, even if they have not yet been paid.

- He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Accruals are recorded through adjusting journal entries, which are made at the end of an accounting period to account for revenues and expenses that have been earned or incurred but not yet recorded. These entries ensure that the proper amounts are reported on the financial statements, providing a more accurate accruals definition picture of a business’s financial position. Accrual basis accounting is a method of accounting where transactions are recorded when they occur, regardless of when cash is received or paid. The accrual method, on the other hand, records transactions when they occur, regardless of when cash is exchanged.

All of our content is based on objective analysis, and the opinions are our own.

On the income statement, accrued revenues increase the company’s revenue, thus boosting its profitability. This is because the revenue is recognized in the period it is earned, providing a more accurate representation of the company’s financial performance. They represent the company’s outstanding obligations that need to be settled in the future. This inclusion of accrued expenses in the balance sheet provides a more accurate picture of the company’s financial position. Accrual accounting is an accounting method that records revenues and expenses before payments are received or issued. It records expenses when a transaction for the purchase of goods or services occurs.

You’ll be able to see how much you’re really making after factoring in things like extra staffing or higher inventory costs. As mentioned above, businesses that track inventory must use accrual accounting, and retailers are no exception. As soon as you sell a product, it records the cost of goods sold (COGS), which gives you a better idea of your true profit on each sale.

Revenue can be recognized in different ways, depending on the type of transaction. If you choose to change your accounting method to use the accrual accounting method, your business must file Form 3115 for IRS approval. Accrual accounting is when you recognize a transaction in your journal entry when it happens instead of when you receive payment. It allows you to track sales and expenses during the period they happen, which helps you better manage busy times like holidays or big sales events.

It’s important to note that while accrued expenses are recognized as liabilities, they do not impact a company’s cash flow. Similarly, if a business incurs expenses in one accounting period but does not pay for them until the next period, accrual accounting recognizes the expenses in the period in which they were incurred. This ensures that the financial statements reflect the true cost of generating revenue during that specific period.

For example, let’s say a client requests a service on April 30th but does not make a cash payment until May 30th. With cash accounting, the revenue generated for the service will not be recognized until cash is received on May 30th. If you have prepaid expenses, it means you’ve already made cash payments for goods and services that you haven’t yet received. When the payment is made on Nov. 25, the consultant credits (credits decrease an asset account) the accounts receivable by $5,000 and debits (debits increase an asset account) cash with $5,000. The general concept of accrual accounting is that accounting journal entries are made when a good or service is provided rather than when payment is made or received.