The utility company generated electricity that customers received in December but it doesn’t bill the electric customers until the following month when the meters have been read. The company must complete an adjusting journal entry to report the revenue that was earned in December to have the proper revenue figure for the year on the utility’s financial statements. The company would make a journal entry to record the expenses as an accrual if it has incurred expenses but has not yet paid them.

Is accrual accounting good or bad?

Revenue and expense recognition is a critical aspect of accrual accounting. By recognizing revenue and expenses when they are earned or incurred, companies can provide a more accurate picture of their financial performance and position. It takes elements from cash basis accounting and combines them with accrual accounting. But, it doesn’t comply with the generally accepted accounting principles (GAAP). At the beginning of each month, let’s say, February, the accountant of company XYZ closes the previous month, i.e.

Our Services

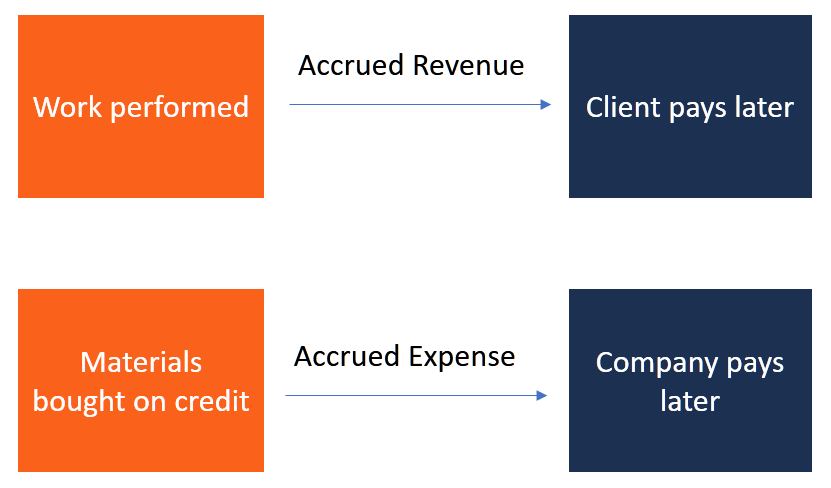

This is common when customers pay for a subscription or have recurring payments, like a phone bill. For example, let’s say a customer paid $100 for your consulting services in January, but you’ll only be providing the service in February. For example, if you provided a consulting service for $100 in January but you expect the customer to pay in February, you’ll have an accrued revenue of $100 in January. Accrued revenue is any income you expect to receive for any good or service you provided.

What Is the Difference Between Cash Accounting and Accrual Accounting?

When expenses are incurred but not yet paid, they are recorded as accrued expenses. This ensures that financial statements provide a more comprehensive and accurate picture of a company’s financial position. The balance sheet reports a company’s assets, liabilities, and equity at a specific point in time. Accrual accounting requires that assets and liabilities be recognized when they are earned or incurred, rather than when cash is received or paid. This means that the balance sheet reflects the company’s financial position at the end of the period, including any outstanding obligations or receivables. One of the key benefits of accrual accounting is that it allows companies to match revenue and expenses more accurately.

Which of these is most important for your financial advisor to have?

Deferred revenue is the term used when your business has received payment for a good or service you haven’t yet provided to them. For example, if your customer has paid for a magazine subscription from your company, but the first issue doesn’t come out for two months, the money is considered deferred revenue. Businesses that use the accrual method of accounting will maintain their ledgers to reflect the current status of an invoice or bill at any given time.

This happens when you receive a good or service, but the provider expects you to pay at a later date. For example, let’s say you received merchandise for your business in March and received an invoice of $500 with payment due in April. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University.

The expenses would be recorded as an accrual in December when they were incurred if a company incurs expenses in December for a service that will be received in January. The accruals are made via adjusting journal entries at the end of each accounting period so the reported financial statements can be inclusive of these amounts. They are recorded as a liability on the balance sheet until they are paid.

- Accruals are created when revenue is earned, or expenses are incurred, but the corresponding cash has not been received or paid yet.

- The revenue from a service would be recorded as an accrual in a company’s financial statements if the company has performed a service for a customer but hasn’t yet received payment.

- Suppose a company relies on a utility, like an internet connection, to conduct business throughout the month of January.

At the time of the payment, the dental office sets up a prepaid expense account for $144 to show it has not yet received the goods, but it has already paid the cash. Accepted and mandatory accruals are decided by the Financial Accounting Standards Board (FASB), which controls interpretations accruals definition of GAAP. Accruals can include accounts payable, accounts receivable, goodwill, future tax liability, and future interest expense. To accrue means to accumulate over time—most commonly used when referring to the interest, income, or expenses of an individual or business.

Accrual accounting is the preferred method of accounting for most businesses. The exception would be very small businesses, or individuals practicing business. Because very small businesses and individuals deal in immediate payment, they can use the cash accounting method. Any business that offers internal credit transactions will be better off relying on the accrual method. Accrual accounting makes it easy to get an accurate picture of your company’s financial health, as you can not only see the money you’ve earned but get the full picture of accrued liabilities and revenue. This also makes it easier to get new investors on board, as you can provide concrete evidence of how your business is doing.